Reported by The Common Wealth Fund, President-elect Donald Trump and Republican leaders of Congress seek to repeal and replace the Affordable Care Act (ACA)—also known as Obamacare—in 2017. A likely strategy is to repeal two key elements of the health reform law: the insurance premium tax credits and the expansion of Medicaid eligibility. A bill passed by Congress in 2015 (H.R. 3762) sought to do just that beginning in 2018—with no replacement plan—but it was vetoed by President Obama. The new Congress could pass a repeal bill in early 2017 but not develop a replacement bill until later.

Repealing Federal Health Reform: Economic and Employment Consequences for States

Jan 10, 2017 4:00:43 PM / by Aquina posted in All, Company News, Financing

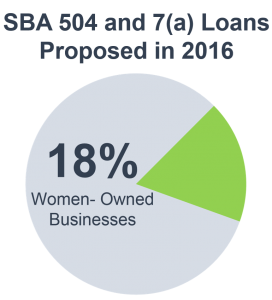

American Banker reports on small business lending by gender

Jan 5, 2017 10:53:24 AM / by Aquina posted in All, Company News, Financing, Growth

According to a recent article published in the American Banker, women are less likely to secure a loan through traditional banks. The article states, “Although women own a third of U.S. small businesses, they get less than 20% of the loans made through the bank-centric, federally backed system.” It goes on to say that “only 5.5% of women business owners obtain commercial loans of any kind from banks or other financial institutions to start or acquire their businesses, compared with 11.4% of male business owners.”

A Capital Investment Before Year-End Can Save You Big Bucks in 2016

Dec 21, 2016 11:47:23 AM / by Aquina posted in All, Financing, Growth, Thought Leadership

As reported by The Balance “Section 179 of the IRS Code was enacted to help small businesses by allowing them to take a depreciation deduction for certain assets (capital expenditures) in year one, rather than over a longer period of time. Taking a deduction on an asset in its first year is called a Section 179 deduction.”

Trump's Business Tax Plan

Dec 20, 2016 11:01:26 AM / by Aquina posted in All, Company News, Financing

According to Donald Trump, the Trump Plan will lower the business tax rate from 35 percent to 15 percent, and eliminate the corporate alternative minimum tax. This rate is available to all businesses, both small and large, that want to retain the profits within the business.

What is a Section 179 Deduction?

Dec 20, 2016 10:43:17 AM / by Aquina posted in All, Company News, Financing

As stated on The Balance, Section 179 of the IRS Code was enacted to help small businesses by allowing them to take a depreciation deduction for certain assets (capital expenditures) in one year, rather than depreciating them over a longer period of time. Taking a deduction on an asset in its first year is called a "Section 179 deduction." You can see that there is a benefit to taking the full deduction for the cost of the item immediately, rather than being required to spread out the deduction over the item's useful life.

A Payment Model That Prevents Unnecessary Medical Treatment

Dec 19, 2016 5:44:50 PM / by Aquina posted in All, Company News, Financing, Healthcare

As stated in the Harvard Business Review, As payers and providers in the U.S. health care system shift from fee for service to value-based approaches that pay providers for quality, they are turning to two models: One is procedure- and DRG-based bundled payments that pay one price for all the care related to treating a condition. The other is population-based “global” or “capitated” payments” such as accountable care organizations in which a provider is paid a fixed amount to cover all of a patient’s health needs for a specified period of time. The Center for Orthopedic Research and Education (or CORE Institute) — a group of musculoskeletal, neurologic, and rehabilitative physicians in Arizona and Michigan that includes orthopedic, spine, and pain-management physicians and a number of other types of clinicians — is pioneering an approach that represents a middle ground. It addresses a central criticism of bundled payments: that the approach doesn’t prevent unnecessary care.

Hospitals Must Create Stellar Post-Acute Care Networks to Meet New Medicare Payment Models

Dec 19, 2016 5:34:48 PM / by Aquina posted in All, Company News, Financing

According to Modern Healthcare, When St. Luke's University Health Network implemented bundled payments for 84 services under Medicare's voluntary bundled-payment program, system leaders knew they needed to whittle down the list of preferred post-acute providers to improve outcomes and save costs.

Keep Cash Flowing This Holiday Season

Dec 14, 2016 10:29:21 AM / by Aquina posted in All, Blog, Financing, Growth

According to an article published this week by Forbes Magazine, the holiday rush can be a stressful time for small businesses. Owners have to account for staffing issues, lack of capital, inventory, and insufficient personal time. And while 81% of the small businesses surveyed feel confident that this season will be a success for their business, only 27% reported not needing additional financing to get through the holidays. Forbes also noted,

Survey: 81% of Small Business Owners Confident this Holiday Season

Dec 13, 2016 11:48:18 AM / by Aquina posted in All, Blog, Company News, Financing, Growth

According to Forbes, the holiday rush can be a stressful time for small business retailers. Owners have to account for staffing issues, lack of capital, inventory, opening another location, boosting advertising, and insufficient personal time. Amidst the shopping, box office blockbusters and holiday cheer, retailers with fewer than 100 employees were surveyed to gauge their outlook for the holiday season.